We have prepared an article about cryptocurrency lending – services for lending in the cryptocurrency market. This is a relatively new form of financial services that has become possible with the development of decentralized finance (DeFi). Cryptocurrency lending is only superficially related to lending in the traditional financial sector and has several key differences. Let’s discuss how lending works in DeFi and also look at popular lending protocols.

Table of Contents

What are DeFi lending protocols?

Lending protocols (or DeFi lending protocols) allow users to take out cryptocurrency loans in the decentralized finance (DeFi) space. In the traditional financial system, financial institutions provide loans to borrowers. DeFi protocols enable peer-to-peer (P2P) lending between network participants. This eliminates the need for intermediaries. Anyone can become a lender and earn interest. Users can borrow cryptocurrency by connecting their cryptocurrency wallet to the platform and immediately use it for trading, staking, or other purposes.

Lending protocols enable borrowers to quickly and easily access funds, and lenders to earn passive income. For the security of cryptocurrency loans, the practice of collateral or overcollateralization is sometimes used in cryptocurrency lending. For example, to borrow 1000 USDT, a user must collateralize 1500 USDT in another currency.

Best DeFi Lending Platforms

Aave

Aave is one of the largest lending platforms in the DeFi space. Launched in 2017 as ETHLend on the Ethereum blockchain, Aave has gradually grown into one of the leading lending ecosystems. The Total Value Locked (TVL) on Aave is over 21 billion dollars across seven blockchain networks.

Most interest rates on Aave range from 1% to 3%, but some coins can generate higher yields. Holding the platform’s native token, AAVE, can reduce trading fees on the platform and is also used for managing the local DAO.

MakerDAO

The MakerDAO platform allows users to lock tokens as collateral for minting DAI, a decentralized stablecoin pegged to the US dollar. MakerDAO’s smart contracts incorporate algorithms to reduce DAI volatility through lending. Platform users can borrow DAI from the protocol using the application. You can collateralize your position with any of the more than 20 tokens on the Ethereum network in exchange for “stability fees”.

MakerDAO offers flexible interest rates for DAI, ranging from 0% to 8.75%. The rates are derived from the stability fees charged to borrowers.

DAI holders can lock their stablecoins in the DAI Wallet and earn passive income at any time. There’s no fee for accessing the DAI Wallet, but users need to pay gas fees when depositing and withdrawing funds. Integration with Compound and Aave protocols is planned for the future, which will enable MakerDAO to offer higher Annual Percentage Yields (APY).

Sturdy.finance

Sturdy.finance is a lending protocol built on the Fantom blockchain, offering lending and interest-free loans. Sturdy provides high Annual Percentage Yields (APYs) for stablecoins, comparable to the interest rates of high-volatility assets. For stablecoins like fUSDT, DAI, and USDC, Sturdy offers an APY of 18.57%.

The platform doesn’t charge interest on loans. Instead, it utilizes user collateral for staking, and the staking rewards are used to pay lenders. The team plans to expand the dApp to EVM-compatible networks and introduce FTM and WETH tokens as collateral over time.

Compound

Compound is a DeFi lending protocol based on the Ethereum network. Lenders’ funds are pooled and utilized by borrowers to pay interest to the protocol. Compound then distributes interest among lenders based on their dynamic Annual Percentage Rate (APR). Lenders receive income in the same token they provided to the protocol.

The Compound APY rates vary from token to token. Some of the highest rates are 3% for USDT and 2.68% for DAI.

Alchemix

Alchemix is a lending protocol that offers self-repaying crypto loans. The protocol allows users to pay off loans using collateral for yield farming in other DeFi protocols. Alchemix automatically calculates the loan amount based on the future yield of the user’s collateral. The protocol utilizes user deposits for farming in other DeFi protocols, and the resulting profit is used to repay the debt.

To start with Alchemix, users need to have at least one DAI token in their wallet. Users deposit DAI into a smart contract and receive alUSD, a liquidity provider token, in return. alUSD can be converted back to DAI on a 1:1 basis or traded on DEX exchanges like Sushiswap, Uniswap, PancakeSwap, etc. Currently, the service only accepts deposits in DAI and ETH.

Fulcrum

Fulcrum is a DeFi lending platform that allows users to lend and borrow ERC20 tokens. It also supports the Polygon and Binance Smart Chain networks. The Fulcrum protocol mints iTokens upon deposit, which can be traded on cryptocurrency exchanges. iTokens become more valuable over time. They can also be used as collateral for borrowing.

Fulcrum offers a wide range of cryptocurrencies and high APYs for stablecoins, such as an 8.4% APY for DAI on the Ethereum network.

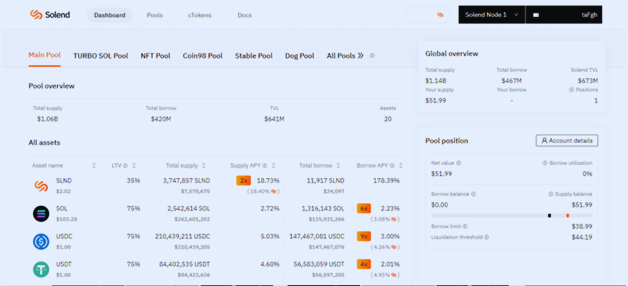

Solend

Solend is a decentralized lending protocol built on the Solana blockchain. Solend’s APY rates depend on the volume of provided liquidity. Some of the highest APYs on the protocol are available for its native token SLND (18%), as well as UST (12.7%), USDT-USDC (7.5%), and RAY (14%).

The platform also has its own token, SLND, for rewards distribution and local DAO governance.

Advantages and disadvantages of lending protocols

Let’s consider some key advantages and disadvantages of DeFi lending platforms.

Loan approval speed. To obtain a DeFi loan, there’s no need to go through checks, provide documents, or wait for approval. Blockchain simplifies all processes: anyone can take a loan almost instantly if they meet the protocol’s conditions.

Transparency. All terms and interest rates are open and cannot be hidden or altered by the platform.

No third-party permissions. Thanks to the openness of the blockchain ecosystem, anyone can use lending protocols without needing permission from third parties and being accountable to them.

Flexibility and precision. All DeFi platforms operate on smart contracts. Given the reliability of smart contracts, working with lending protocols minimizes risks and human error. Flexibility is increased.

User control over assets. DeFi loans allow users to have complete control over their digital assets. Funds are stored only in the user’s cryptocurrency accounts and are entirely under their control.

Stability and immutability. Changing data in the blockchain is nearly impossible. Users have the ability to verify smart contracts and their execution to ensure conditions are met and funds are secure.

Cross-integration. Most DeFi protocols gradually integrate support for multiple blockchains, making them even easier to use and opening additional opportunities for borrowers and lenders.

As for disadvantages of lending services, one can point out the less intuitive User Experience, which is characteristic of the entire DeFi environment. Lending protocols require an understanding of how cryptocurrency wallets and blockchain networks work, as well as complex interest calculation mechanisms. Furthermore, relatively new protocol mechanisms can experience periodic glitches, especially when dealing with different cryptocurrency wallets.

Additionally, lending protocols in the DeFi environment are unregulated, and smart contracts can be vulnerable. Lending protocols do not fall under any regulatory framework. The funds deposited in the protocols do not have insurance mechanisms like those offered by banks and other traditional financial institutions. When choosing a lending protocol, users rely on reviews, personal analysis, and confidence in the service’s reliability.

Conclusion

Lending protocols are a rapidly growing segment of the cryptocurrency market. Compared to traditional lending, DeFi lending offers faster loan processing and a user-centric approach. Most protocols feature flexible interest systems aimed at benefiting all three parties: the protocol, borrower, and lender. New users should stick to established protocols, as new services in the DeFi space may not always prove the reliability of their smart contracts.

An experienced leader in software engineering and technology, I’ve driven value for top-tier Fortune 100 and 500 clients as the former CTO of Big Drop Inc. Overseeing a global team, we secured 34 global awards for pioneering web design using our proprietary tech. As the Co-Founder of Motion Design School, I created an innovative platform for global artists. Now, I apply my expertise to the dynamic world of blockchain, leveraging years of experience to shape decentralized technology’s future.