Decentralized exchanges (DEXs) are platforms that facilitate peer-to-peer trading of cryptocurrencies without relying on intermediaries or central authorities. Unlike centralized exchanges, which require users to deposit their funds and trust the exchange with custody, DEXs operate directly on the blockchain through smart contracts, ensuring a trustless and transparent trading environment.

Table of Contents

Popular Solana DEXs

Solana’s growing ecosystem has fostered the development of several popular DEX platforms. Let’s explore 10 notable Solana DEXs and highlight their unique features:

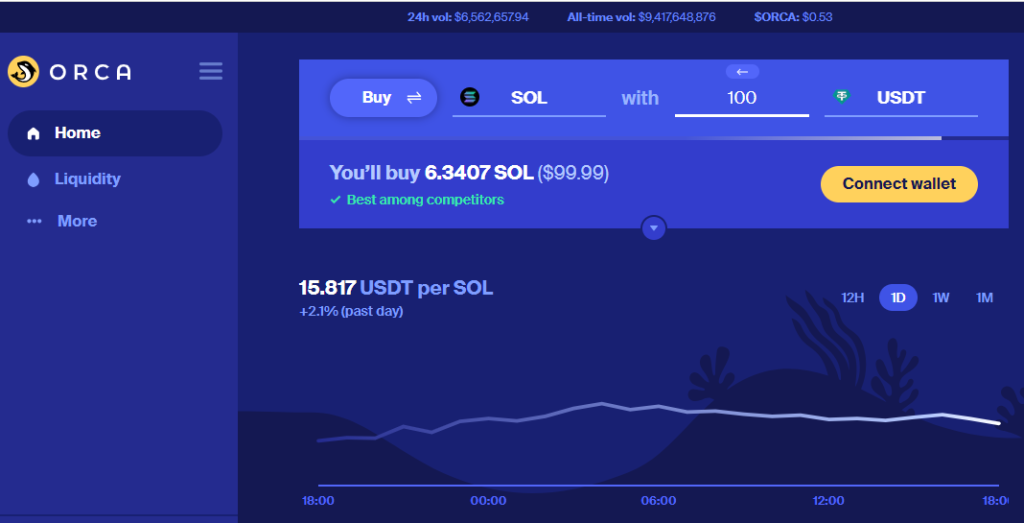

Orca

Orca is a feature-rich DEX that provides users with access to trading, staking, and farming on the Solana blockchain. It offers unique features like customizable trading interfaces, portfolio tracking, and governance participation.

Key Advantages

- Customizable trading interface

- Portfolio tracking

- Wide range of supported tokens

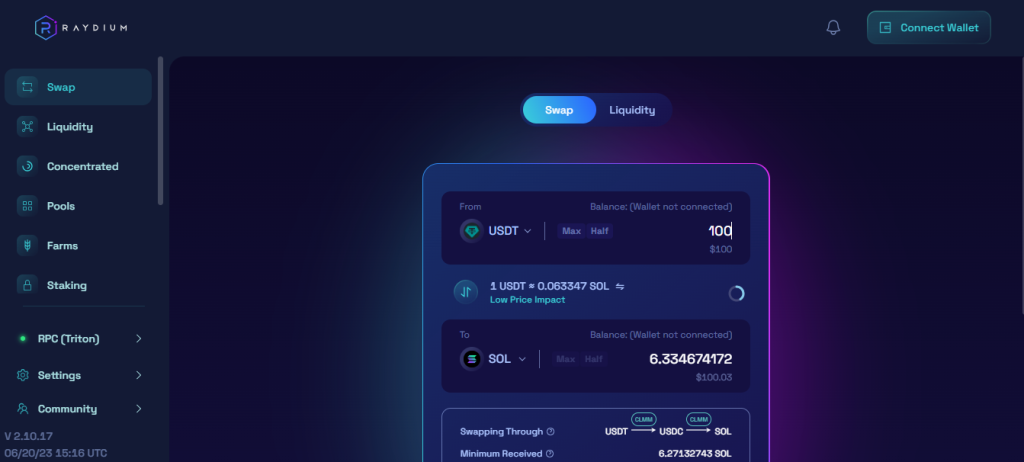

Raydium

Raydium is an automated market maker (AMM) that combines liquidity pools with the Serum order book. It offers low slippage trading, yield farming opportunities, and integration with other DeFi projects.

Key Advantages

- Low slippage trading experience

- Yield farming capabilities

- Leveraging Solana’s high-speed and low-cost transactions

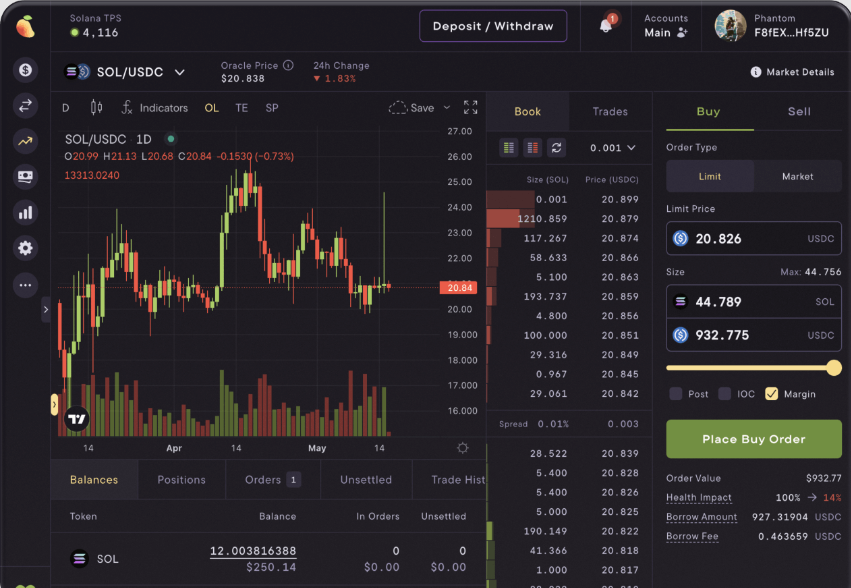

Mango Markets

Mango Markets is a user-friendly DEX that allows traders to access leverage trading, spot markets, and liquidity pools. It also features a customizable and intuitive trading interface.

Key Advantages

- User-friendly interface

- High transaction speed

- Cross-margin trading capabilities

Solanium

Solanium combines a DEX with an IDO (Initial DEX Offering) platform. Users can participate in token sales, liquidity mining, and trading. It focuses on simplicity and accessibility for both beginners and experienced traders.

Key Advantages

- Token sale participation opportunities

- Liquidity mining features

- Comprehensive platform covering various aspects of DeFi on Solana

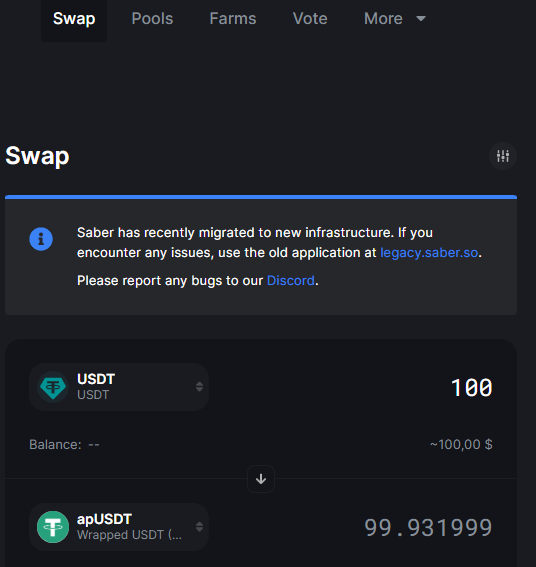

Saber

Saber is an AMM protocol on Solana that focuses on stablecoin trading and liquidity provision. It offers low fees, stablecoin swaps, and integration with cross-chain bridges.

Key Advantages

- Stablecoin trading focus

- Low fees

- Liquidity provision opportunities

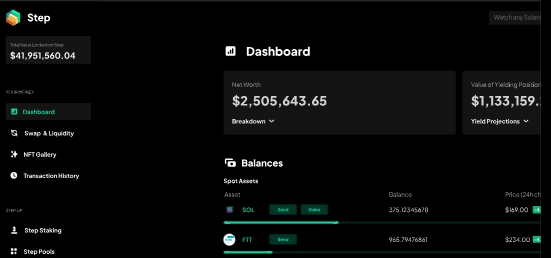

Step Finance

Step Finance is a decentralized portfolio management and trading platform. It allows users to manage their assets across various Solana DEXs, access real-time data, and automate trading strategies.

Key Advantages

- Portfolio management features

- Integration with multiple Solana DEXs

- Comprehensive trading and tracking capabilities

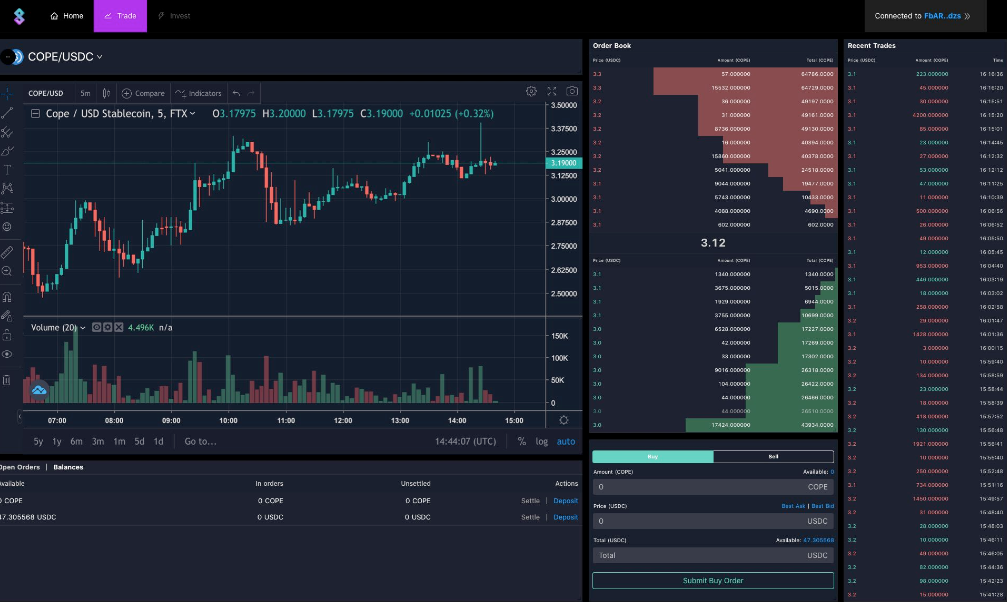

Bonfida

Bonfida offers a suite of tools and services for Solana users, including a DEX, Serum market analytics, portfolio tracking, and token swaps. It aims to provide a comprehensive DeFi experience on Solana.

Key Advantages

- All-in-one trading platform

- Market analytics and portfolio tracking features

- Token swap capabilities

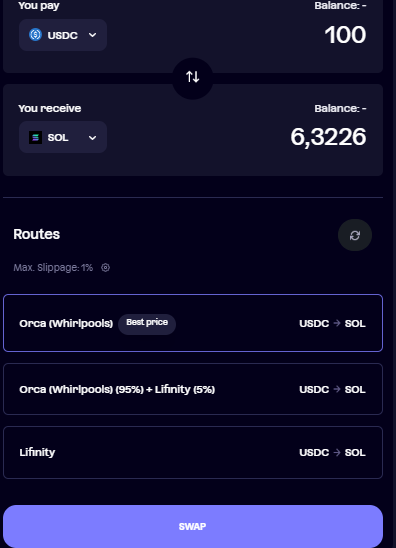

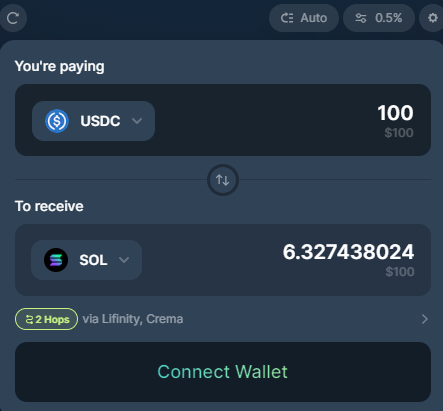

Jupiter Aggregator

Jupiter Aggregator aims to be the ultimate centralized exchange (CEX) replacement on the Solana blockchain, providing low transaction fees and a superior user experience. Token Swaps and Limit Orders are available.

Key Advantages

- Split trade

- Smart routing

- Powerful Jupiter SDK

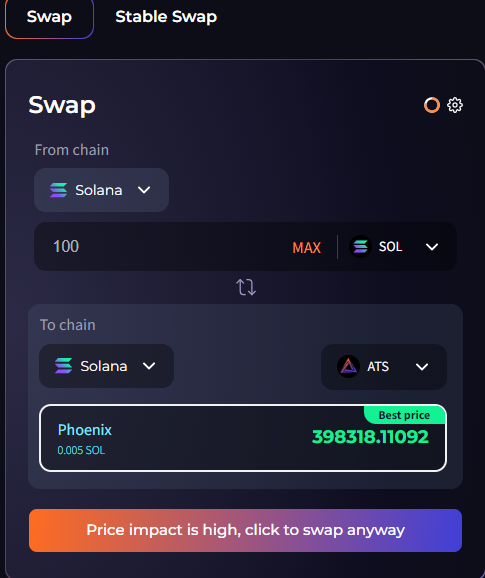

Atlas Dex

Atlas DEX is an innovative decentralized exchange (DEX) that aims to revolutionize cross-chain decentralized finance (DeFi). With its focus on cross-chain interoperability, Atlas DEX enables seamless native cross-chain swaps on leading blockchains. It introduces pioneering DeFi 3.0 with its cross-chain innovations, making it easier than ever to trade native tokens across multiple chains.

Key Advantages

- Cross-Chain Trading

- Minimal Slippage

- Aggregated Liquidity

- ATS Staking: Atlas DEX introduces the $ATS token, which users can stake to earn rewards and access exclusive benefits.

- Swap Pools and Farms:

- Multi-Chain Dashboard

Each of these Solana DEXs brings its unique set of features and benefits to the ecosystem. It’s important to explore and understand the specific offerings of each platform to determine which one aligns best with your trading preferences and requirements. Remember to conduct thorough research, consider liquidity, fees, and user feedback when choosing a Solana DEX for your decentralized trading activities.

Key Differences DEX from Centralized Exchanges

While centralized exchanges have dominated the cryptocurrency trading landscape, DEXs offer several distinct advantages. Firstly, DEXs prioritize privacy since users retain control over their funds throughout the trading process. This reduces the risk of hacks or security breaches associated with centralized exchanges. Additionally, DEXs enable non-custodial trading, meaning users have sole control and ownership of their assets, eliminating the need to trust a third party with custody.

Solana DEXs, specifically built on the Solana blockchain, bring additional benefits. Solana is known for its high-performance blockchain, offering blazing-fast transaction speeds and low fees, making it ideal for decentralized trading. The Solana ecosystem has seen significant growth, attracting a vibrant community and a diverse range of projects, further enhancing the potential of Solana DEXs.

Advantages of Solana DEXs

Enhanced Privacy

One of the key advantages of using Solana DEXs is enhanced privacy. Unlike centralized exchanges that require users to deposit their funds onto the exchange, Solana DEXs allow you to retain control of your assets in your own wallet throughout the trading process. This means that you are not exposing your funds to the potential risks associated with centralized custody. By eliminating the need for a central authority to hold your assets, Solana DEXs provide a more private and secure trading experience.

Non-Custodial Trading

Solana DEXs enable non-custodial trading, which means that you have complete control over your funds at all times. You don’t need to trust a centralized exchange with your assets or rely on their security measures. Instead, you connect your Solana wallet directly to the DEX platform and trade directly from your wallet. This non-custodial approach ensures that you are the sole owner of your assets and reduces the risk of hacks or potential loss of funds due to exchange vulnerabilities.

Faster Transaction Speeds

Solana’s high-performance blockchain is renowned for its incredibly fast transaction speeds. This speed advantage is particularly beneficial when trading on Solana DEXs. With faster transaction confirmations, you can execute trades quickly and take advantage of market opportunities without delays. Solana’s network is designed to handle a high volume of transactions per second, ensuring that you can trade efficiently even during periods of peak activity. Additionally, the low fees associated with Solana transactions make trading on Solana DEXs cost-effective.

By utilizing Solana DEXs, you can enjoy enhanced privacy, maintain control over your funds, and take advantage of the lightning-fast transaction speeds offered by the Solana blockchain. These advantages make Solana DEXs an appealing option for decentralized trading and contribute to the growing popularity of the Solana ecosystem.

Getting Started with Solana DEXs

Choosing a Solana Wallet

Before you can start trading on Solana DEXs, you need to choose a compatible Solana wallet. Some popular options include Sollet, Phantom, and Solflare. These wallets provide a user-friendly interface and allow you to securely manage your Solana assets. Research each wallet’s features, security measures, and user reviews to determine which one best suits your needs. Once you have selected a wallet, follow the wallet provider’s instructions to create and secure your wallet.

You can read our article Best Solana Wallets.

Connecting Your Wallet to a DEX

Platform After setting up your Solana wallet, you’ll need to connect it to a Solana DEX platform. Popular Solana DEXs include Raydium, Mango Markets, Solanium, and Orca. Visit the official website of your chosen DEX platform and ensure you are on the correct domain to avoid phishing scams. Look for the wallet connection option on the DEX platform and select your Solana wallet provider. Follow the prompts to connect your wallet by approving the connection request. This will establish a secure connection between your wallet and the DEX platform.

Navigating the User Interface

Once your wallet is connected, familiarize yourself with the user interface of the Solana DEX platform you have chosen. Explore the available trading pairs, price charts, order books, and other features. Each platform may have a slightly different layout and functionality, so take some time to understand how to navigate and access the necessary information.

Executing Trades

To execute a trade on a Solana DEX, start by selecting the trading pair you want to trade. For example, if you want to trade SOL for USDC, locate the SOL/USDC trading pair. Enter the desired amount and the price at which you want to execute the trade. You can choose between market orders, limit orders, or other order types offered by the DEX platform. Review the transaction details, including the estimated transaction fees, before confirming the trade. Once you are satisfied, approve the transaction in your Solana wallet. The trade will be executed on the Solana blockchain, and you will be able to see the updated balances in your wallet.

Understanding Liquidity, Slippage, and Transaction Fees

Liquidity and its Importance

Liquidity plays a vital role in the functioning of decentralized exchanges. In simple terms, liquidity refers to the availability of buyers and sellers in a particular market. High liquidity means there are abundant participants willing to buy or sell assets, making it easier to execute trades at desired prices. On the other hand, low liquidity can result in slippage, where the executed price deviates from the expected price due to the limited availability of assets in the order book.

When trading on Solana DEXs, it’s beneficial to choose trading pairs with sufficient liquidity to ensure smooth trade execution and minimize the impact of slippage. Higher liquidity also implies that you can enter and exit positions more easily, even when dealing with larger trading volumes.

Slippage and its Impact on Trading

Slippage refers to the difference between the expected price of an asset at the time of placing an order and the executed price when the order is filled. Slippage can occur in situations where there is low liquidity or when the market experiences high volatility. It’s important to be aware that slippage can lead to buying or selling assets at higher or lower prices than anticipated, potentially affecting your trading outcomes.

To minimize slippage, consider using limit orders instead of market orders. Limit orders allow you to set the maximum price you are willing to pay when buying or the minimum price you are willing to accept when selling. By setting specific price levels, you have more control over the execution price and can potentially avoid excessive slippage.

Transaction Fees and Considerations

When trading on Solana DEXs, you will encounter transaction fees. These fees are paid to validators who process and validate transactions on the Solana blockchain. The fees can vary depending on the network congestion and the specific DEX platform you are using. It’s essential to consider these transaction fees when evaluating the costs of trading on a Solana DEX.

Transaction fees are typically denominated in the native currency of the blockchain, such as SOL on the Solana network. It’s important to assess the fees associated with each trade and factor them into your trading decisions. Some DEX platforms may allow you to adjust the transaction fee level, allowing you to prioritize faster transaction confirmations or opt for lower fees.

Risks Associated with Solana DEXs

While Solana DEXs offer numerous advantages, it’s essential to be aware of the potential risks involved. Understanding these risks can help you make informed decisions and take appropriate precautions when engaging in decentralized trading on the Solana blockchain. Here are two significant risks associated with Solana DEXs:

Impermanent Loss

Impermanent loss is a concept specific to liquidity provision in decentralized exchanges. When you provide liquidity to a pool on a Solana DEX, your funds are used to facilitate trades. The value of your assets in the pool may fluctuate in relation to external market movements. If the price of one token in the pool significantly outperforms the other, you may experience impermanent loss when withdrawing your liquidity. Impermanent loss occurs when the value of your initial assets would have been higher if you had held them outside the liquidity pool.

It’s important to carefully consider the potential risks of impermanent loss and assess whether the potential returns from providing liquidity outweigh the risks. Proper diversification and understanding the dynamics of the assets in the liquidity pool can help mitigate the impact of impermanent loss.

Potential Scams and Security Risks

Decentralized exchanges operate in a permissionless and open environment, which can attract malicious actors seeking to exploit vulnerabilities. Scammers may create fake DEX platforms or tokens, aiming to deceive users and steal their funds. It’s crucial to exercise caution and perform thorough due diligence before using any Solana DEX platform or engaging with new projects.

To mitigate the risks of scams and security breaches, follow these best practices:

- Verify the authenticity of the DEX platform by ensuring you are on the official website and checking community consensus.

- Review the smart contract code and audit reports if available.

- Be cautious of tokens with inflated promises or unrealistic returns.

- Double-check token addresses and verify contract interactions before approving transactions.

- Utilize reputable Solana wallets and enable necessary security features such as multi-factor authentication.

By staying vigilant and practicing good security hygiene, you can minimize the potential risks associated with scams and security vulnerabilities in Solana DEX trading.

Can I participate in Solana DEXs without providing personal information?

Yes, one of the advantages of using DEXs is that they typically do not require users to provide personal information. Since DEXs operate on a decentralized infrastructure, users can trade without going through extensive identity verification processes.

How can I mitigate risks when trading on Solana DEXs?

Perform thorough research: Conduct due diligence on the DEX platform, token projects, and liquidity providers before engaging in trades.

Diversify your investments: Spread your investments across different projects or liquidity pools to reduce the impact of potential losses.

Use reputable platforms: Stick to well-established and reputable Solana DEXs that have undergone audits and have a strong community presence.

An experienced leader in software engineering and technology, I’ve driven value for top-tier Fortune 100 and 500 clients as the former CTO of Big Drop Inc. Overseeing a global team, we secured 34 global awards for pioneering web design using our proprietary tech. As the Co-Founder of Motion Design School, I created an innovative platform for global artists. Now, I apply my expertise to the dynamic world of blockchain, leveraging years of experience to shape decentralized technology’s future.